Supply chain companies are slowly implementing transformations to their respective supply chains, while most, 59% of European and 51% of US companies, have a strategic priority for a green supply chain in place. While companies realise the importance of becoming sustainable, the primary motivation to do so remains business oriented.

Going green has been propelled up the supply chain management agenda, on the back of sustainability expectations from consumers and demands from regulators. The Paris climate change accord, as well as wider changes in perception about viability of the current economic model in the long term, mean that the issue is no longer one that can be conveniently ignored. Even in the business world – ruled by profit – research from BCG and MIT Sloan Management Review, found that investors are becoming more concerned about their investments meeting sustainability criteria.

New research highlights that supply chain management companies continue to transform their operations to meet changes within the market in favour of sustainability; momentum has slowed somewhat, as low-hanging fruit initiatives are completed and insufficient regulatory force pushes for deeper change. In its latest ‘Supply Chain Monitor – from green to sustainable supply chain management’ report, consulting firm BearingPoint considers the state of the industry in Europe and the US as well as the stance towards sustainability issues. The research involved 215 European companies and 51 US companies.

The green supply chain a strategic priority

The research finds that almost 60% of European supply chain companies posit the green supply chain as a strategic priority, while 51% do in the US; these numbers are slightly lower than the 60% average across industries reported by BCG. 21% of companies in the US are planning to implement strategies in the mid-term, however, with only 6% planning to do so in the Europe. In a 3-5 year period, 10% plan to introduce such a strategy in Europe, while 8% plan to do so in the US.

The growing importance of sustainability

The research also considers in how far a green supply chain has increased in strategic priority for European companies. The Nordics have placed the highest value on increased effort in bringing about improvements, at 62% of respondents, followed by the GSA region (Germany, Switzerland & Austria) at 57% and France & Benelux at 55%.

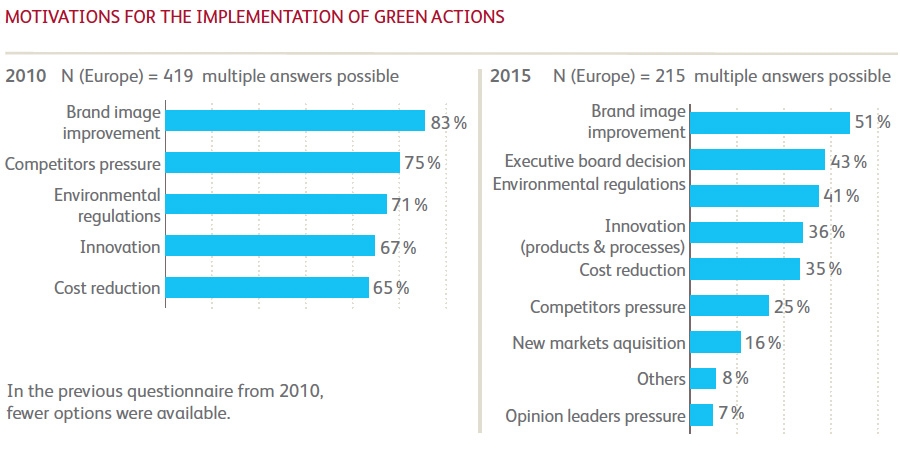

Motivation for implementation of green action

The research further asks respondents to indicate their motivations for developing their respective supply chain towards sustainability. The survey found that brand image improvement remained the top priority for companies, at 51% of respondents, followed by executive board decision, at 43% of respondents. Environmental regulation comes in third, as cited by 41% of respondents. Cost reduction was cited by 35% of respondents.

In the US too the biggest motivation was brand image improvement, at 53% of respondents. Innovation of products and processes came in second at 47%, followed by executive board decisions at 45%. Environmental regulations and cost reductions came in at 37% and 35% respectively.

Willingness to invest without direct financial benefits

While business principals, focused on financial benefits, tend to determine corporate activity at large, some respondents showed willingness to invest in environmental protection even without such benefits. The survey found that 26% of companies are willing to do so, while 43% have already undertaken such a move. 19% say that they are not willing to invest without tangible returns on their investment.

ROI for environmental protection

In terms of environmental protection strategies that were implemented, the return on investment for those policies varied considerably between Europe and the US. In Europe, 47% of projects took up to three years to pay off, while 34% took more than three years. 5% of projects did not pay off at all. In the US, only 15% of initiatives paid off within three years, 31% paid off after more than three and 10% haven’t paid for themselves at all. The US too had a large number of respondents, 44% of the total, that stated that such information was not available.

for further information see www.consultancy.uk